Amid low inventory and sky-high demand, home prices rose at a steady rate this spring — even as fears of a pandemic-induced downturn remain.

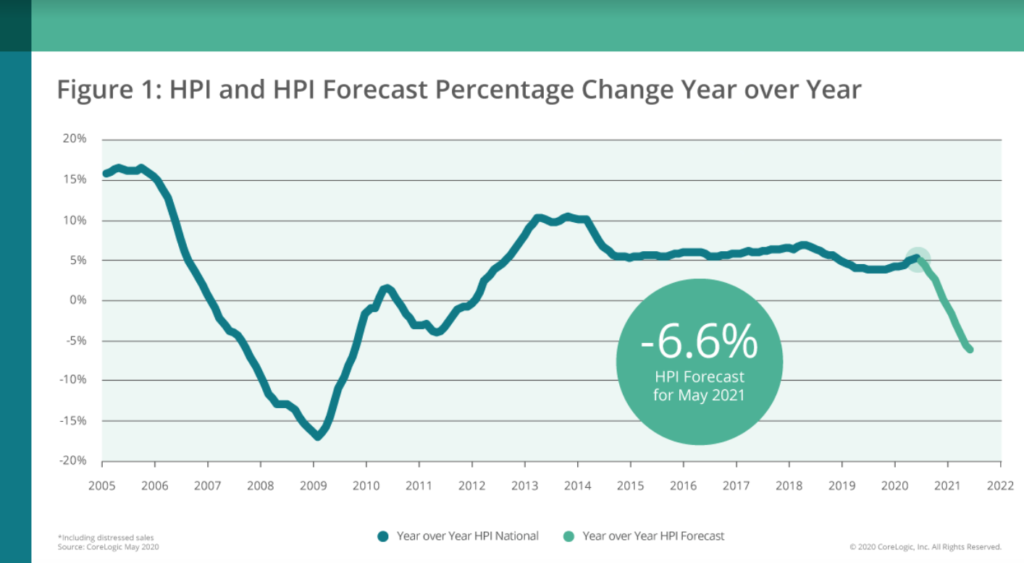

In May, home prices rose by 4.8 percent year over year. According to the latest data from property analytics provider CoreLogic, the numbers reflect both the pent-up demand for housing during spring’s lull and the low inventory of homes on the market.

CoreLogic

“Home-purchase activity, bolstered by record-low interest rates, continues to exceed expectations despite the severe recession,” said Frank Martell, president and CEO of CoreLogic, in a prepared statement. “Pent-up buyer demand was delayed from spring to summer and is reflected in the latest price data. But with elevated unemployment, purchase activity and home prices could fall off after summer.

Our Take

As we have noticed, housing demand is still reaching heights that were not expected. The question now – what comes next?

For us in Connecticut – we are grappling with two opposing forces. On one hand we have a growing recession that seems to be looming on the horizon. On the other, we have a huge NYC migration that is making its way into Connecticut suburbs (up to about 16,000 now by latest reports). Will these two elements cancel each other out in terms of business? We are also interested to see how this influx of buyers effects home prices. We already know that prices were on the rise, what happens when Manhattan budgets meet Greenwich suburbs? We are keeping an eye on this in our own business so that we can better meet demand and also keep prices affordable for local families.

Happy Wednesday

-The Altered Properties Team